Want to protect your wealth and minimize taxes? Combining tax and estate planning is the key to transferring assets efficiently and avoiding costly mistakes. Here's how:

- Why it matters: Integrated planning aligns tax strategies with estate goals, reducing risks, costs, and missed opportunities.

- Key steps:

- Evaluate finances and estate documents for gaps.

- Use tools like GRATs, QPRTs, and SLATs for tax-efficient wealth transfers.

- Align asset ownership and beneficiary designations to avoid conflicts.

- Regularly update your plan to adapt to tax law changes and life events.

- Example: Life insurance in an irrevocable trust can lower estate taxes and provide liquidity.

Act now to stay ahead of the 2026 exemption reduction. A unified plan ensures your wealth is preserved and passed on effectively.

1: Evaluate Client's Financial and Estate Situation

Collect Financial Data

Start by gathering detailed financial information. This includes liquid assets like bank accounts, investments, and retirement funds, as well as fixed assets such as real estate, business ownership, and vehicles. Don’t forget to account for income sources (employment, investments, or rental income) and liabilities like mortgages, loans, or personal debts. Tracking tax bases is also critical to evaluate potential capital gains impacts when planning wealth transfers.

Examine Estate Planning Documents

Take a close look at the client's estate planning documents. This involves reviewing wills, trusts, powers of attorney, life insurance policies, business succession plans, and asset titling. The goal is to uncover any gaps or outdated strategies that might create issues later. Ensuring these documents align with tax-saving strategies is essential for a cohesive approach.

"The time has come for asset protection planning and estate planning to be joined into a new concept-integrated estate plan(ning) (IEP)" [6].

Assess Tax Exposure and Family Dynamics

Analyze the client's tax situation, focusing on both current and future liabilities. This includes income tax brackets, estate taxes, gift taxes, and generation-skipping transfer taxes. These insights are key to building tax-efficient strategies for wealth transfers.

Family dynamics play a major role in estate planning. Consider factors like special needs (requiring trust structures), business ownership (needing succession planning), charitable goals (for tax-efficient giving), and potential family conflicts (requiring asset protection strategies). Understanding the family's values and goals ensures a plan that balances tax considerations with family harmony.

With this groundwork in place, advisors can move forward to craft a personalized tax and estate plan tailored to the client's unique needs.

2: Develop a Customized Tax and Estate Plan

After assessing your client’s financial and estate circumstances, the next step is to implement personalized strategies for transferring wealth effectively.

Wealth Transfer Tools

Several tools can help clients pass on wealth while managing tax obligations:

- Grantor Retained Annuity Trusts (GRATs): These allow asset appreciation to be transferred to beneficiaries without triggering gift taxes. The grantor receives annual payments for a set term, and any future growth is passed along tax-free.

- Qualified Personal Residence Trusts (QPRTs): Ideal for transferring real estate, QPRTs reduce the taxable value of the gift while letting the grantor live in the property for a specified period.

- Family Limited Partnerships (FLPs): Business owners can use FLPs to gradually transfer wealth, retain control, and reduce the taxable value of assets.

Once these tools are in place, the focus shifts to optimizing tax outcomes with targeted approaches.

Tax-Efficient Approaches

Tax efficiency involves using strategies tailored to individual situations. Here are some key methods:

- Roth Conversions: These allow for tax-free growth over time.

- Life Insurance Trusts: Provide estate tax-free liquidity for estate tax payments or direct wealth transfers.

- Charitable Remainder Trusts: Combine income generation with philanthropic goals.

Other approaches include making direct payments to educational or medical providers, which bypass gift taxes, and using Intentionally Defective Grantor Trusts (IDGTs). These trusts remove assets from the estate but require the grantor to pay income taxes on trust earnings, enabling tax-free transfers [1][7].

"Life insurance is a great wealth transfer asset because the proceeds are inherited estate and income tax free, and can be used for goals like providing liquidity to pay for estate taxes, or transferring wealth directly to your beneficiary(ies)." [5][4]

Another option is Spousal Lifetime Access Trusts (SLATs), which offer estate tax savings while allowing indirect access to trust assets through a spouse.

3: Align Asset Titling and Beneficiary Designations

Making sure asset titling and beneficiary designations are aligned is key to ensuring your tax and estate planning strategies work together effectively.

Adjusting Asset Ownership

The way assets are titled affects how wealth is transferred and must match your estate plan to avoid potential issues.

| Title Structure | Key Benefits | Best Used For |

|---|---|---|

| Joint Tenants with Right of Survivorship (JTWROS) | Skips probate, transfers automatically | Shared accounts for married couples |

| Payable on Death (POD)/Transfer on Death (TOD) | Direct transfer, avoids probate | Individual bank and investment accounts |

| Revocable Trust | Offers privacy, control, avoids probate | Real estate, investments, business interests |

| Sole Ownership | Full control during lifetime | Personal property, individual accounts |

When setting up asset titles, think about how they fit into your overall estate plan. For example, if you've created a revocable trust, you’ll need to retitle assets in the trust’s name to take full advantage of its benefits. Once your asset titling is in order, the next step is ensuring your beneficiary designations are on the same page.

Keeping Beneficiary Details Up to Date

Beneficiary designations take priority over wills and trusts, making them a critical part of your plan. Wells Fargo Advisors explains:

"Beneficiary designations take precedence over what you may have specified in a will or trust" [2][3].

You should review these designations during major life events - like marriage, divorce, or the birth of a child - or at least every 2-3 years.

Here are some tips for updating beneficiaries:

- Name both primary and contingent beneficiaries to have a backup plan.

- Use specific names instead of general terms like "my children."

- Avoid naming your estate as a beneficiary to steer clear of probate complications.

- Be mindful of tax consequences for your beneficiaries.

- Make sure your designations align with your overall estate planning strategy.

Certain assets, such as life insurance policies, retirement accounts (401(k)s, IRAs), annuities, and pensions, allow for direct beneficiary designations. Coordinating these with your estate plan ensures a smoother wealth transfer process and helps minimize taxes.

sbb-itb-e3190ce

4: Maintain a Review and Update Process

After aligning your assets, the next step is to keep your plan relevant through consistent reviews and updates. This ensures your tax and estate plans remain effective as laws and personal circumstances evolve.

Set up regular reviews to address changes in tax laws, major life events, and shifts in health. Schedule annual check-ins to assess investment performance and ensure your estate plan still aligns with your goals. Major life events like marriage, divorce, births, or deaths should prompt immediate updates. For health-related directives, consider a review every 2-3 years.

Collaboration with a professional team is key. Estate attorneys, tax professionals, and financial advisors should work together to ensure every part of your plan is synchronized and up-to-date.

"Integrated estate planning is all about making sure that all of the pieces to your estate plan fit well together" [7].

These professionals should meet at least once a year to review the plan’s components. Additional meetings may be necessary if there are significant changes in tax laws or your personal circumstances. Regular collaboration ensures your plan stays effective and cohesive.

Bonus Resource: Marketing Tools for Financial Advisors

Marketing plays a crucial role for financial advisors offering tax and estate planning services. With nearly 46% of high-net-worth investors looking for new wealth management relationships [1], having the right tools can make all the difference. Resources like the free list of 51 marketing tools and the Email Extractor Tool can simplify your marketing efforts, helping you attract and retain clients more effectively.

Financial Advisor Marketing: Free List of 51 Tools

This free resource includes 51 carefully selected tools designed to help advisors manage client relationships, create engaging content, and maintain a strong social media presence. These tools are tailored to highlight your expertise in tax and estate planning. For instance, email marketing stands out with an impressive average ROI of $36 for every dollar spent [2], showcasing how impactful targeted campaigns can be.

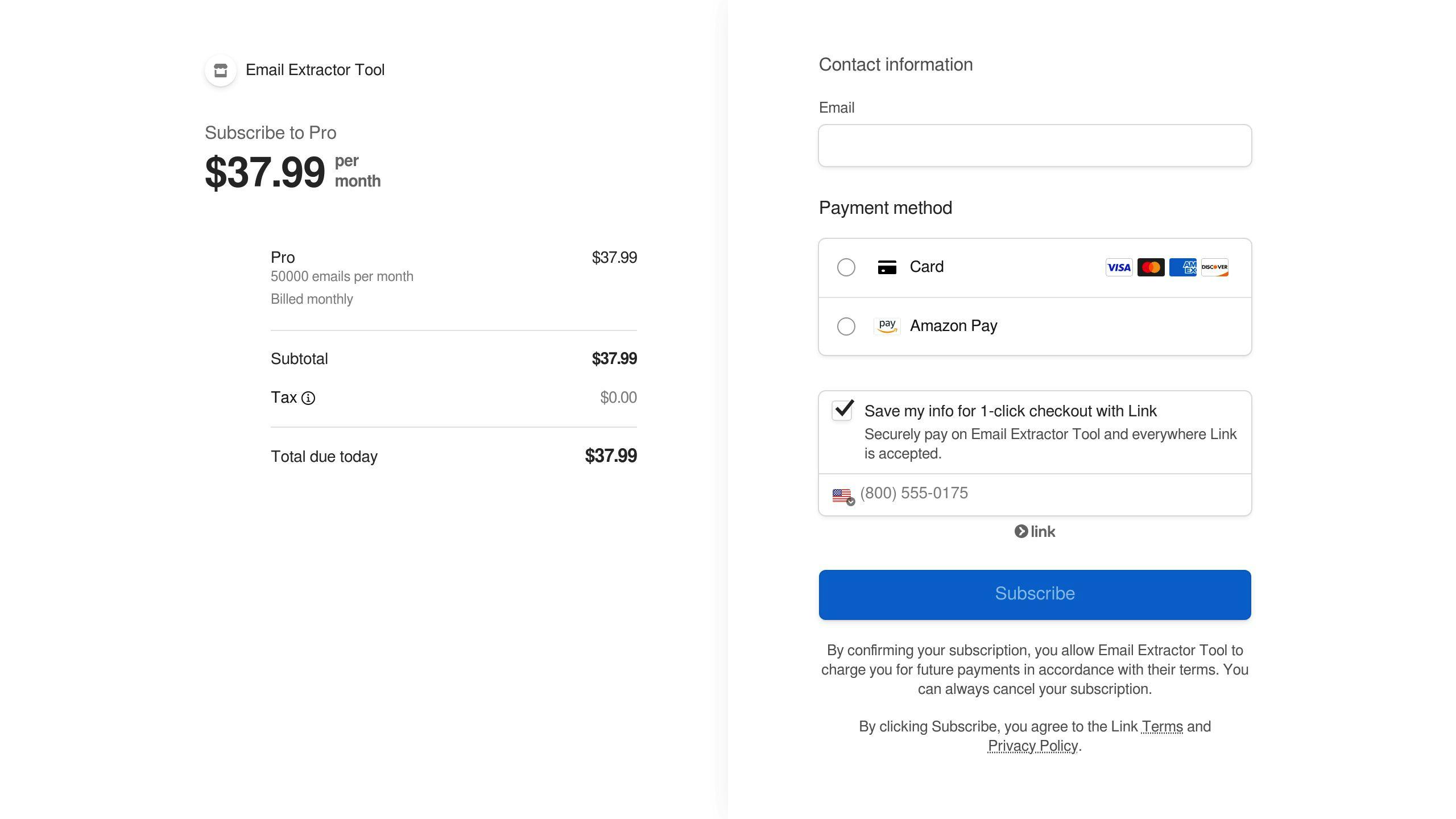

Email Extractor Tool

Priced at $37.99, the Email Extractor Tool is a powerful way to reach high-net-worth individuals seeking comprehensive planning services. It helps you identify qualified prospects, making it easier to connect with those who need your expertise.

Some effective marketing strategies for promoting integrated planning services include:

- Crafting content that highlights your tax and estate planning knowledge

- Running targeted email campaigns to nurture potential clients

- Establishing credibility through social media

- Using videos to simplify complex planning concepts

Research shows a strong link between engagement and understanding: 91% of highly engaged clients feel their advisors truly understand their needs, compared to just 53% of less engaged clients [4]. By using these tools and strategies, financial advisors can clearly communicate their value and stand out in a competitive market.

Conclusion: Key Points for Financial Advisors

Why Combine Tax and Estate Planning?

Bringing together tax and estate planning helps reduce tax burdens and ensures assets are passed on efficiently. This approach not only improves outcomes for clients but also strengthens their trust in your services. For example, trust-based gifting can lower estate taxes and limit capital gains through a step-up in basis. To make this work, a well-organized plan is essential.

How to Put It Into Action

Financial advisors can achieve integration by following a structured process that focuses on assessment, strategy, and ongoing management.

| Phase | Key Actions | Outcomes |

|---|---|---|

| Initial Assessment | Gather financial data and review estate documents | Understand the client's current position |

| Strategy Development | Use tax-efficient tools and adjust asset titling | Align strategies with client goals |

| Ongoing Management | Conduct regular reviews to adapt to tax law changes | Maintain long-term effectiveness |

With the 2026 exemption reduction on the horizon, acting now can make a big difference.

"Proactive planning now ensures control over wealth distribution, despite upcoming tax changes." - Policy Engineer, Financial Planning Expert

Collaboration with legal and accounting professionals is also crucial for success. By working together, advisors can provide better results for clients and build a stronger practice.