Looking for the best ROI reporting tool? Here's a quick guide to help you decide:

- Why It Matters: ROI tools help financial advisors track performance metrics, cut costs, and improve efficiency. For instance, tools like FYIsoft can boost productivity by 300% and reduce financial close times by 50%.

- Must-Have Features:

- Integration with CRMs and marketing platforms (e.g., AdvisorEngine for real-time data).

- Customizable reports for client-specific needs (e.g., FundPanel templates).

- Scalable systems that grow with your business.

- Metrics to Track:

- Customer Acquisition Cost (CAC): Know how much it costs to gain a client.

- Customer Lifetime Value (CLV): Measure total revenue per client over time.

- Conversion and Churn Rates: Understand client retention and engagement.

- Popular Tools:

- Google Analytics: Free website performance insights.

- HubSpot: Starting at $50/month, offers lead tracking and automation.

- Mixpanel: $25/month for real-time analytics and behavior tracking.

- Financial Advisor Marketing: Campaign tracking tailored for advisors.

Quick Comparison Table

| Tool | Starting Price | Key Features | Best For |

|---|---|---|---|

| Google Analytics | Free | Website performance tracking | Basic insights |

| HubSpot | $50/month | Lead scoring, automation, email tracking | Marketing and ROI tracking |

| Mixpanel | $25/month | Real-time analytics, event tracking | Client behavior analysis |

| Financial Advisor Mktg | Custom pricing | Campaign effectiveness, CAC tracking | Advisor-specific insights |

Start with a free trial or demo to test compatibility with your business needs. Focus on tools that align with your goals, track critical metrics, and simplify operations.

Features to Look for in an ROI Reporting Tool

Key Features to Prioritize

A good ROI reporting tool should work smoothly with the systems you already use, saving time and reducing mistakes. Look for tools that integrate with your CRM, marketing platforms, and portfolio management systems. For instance, integration with platforms like AdvisorEngine allows for real-time data access, cutting down on manual work [3].

Customizable reports are another must-have. Tools like FundPanel offer templates that can be tailored to meet specific client needs [2]. For financial advisors, this flexibility makes it easier to deliver reports that match client preferences and adapt to changing business goals.

Key features to consider include:

- Flexible dashboards that cater to various stakeholders

- Interactive tools for exploring data

- Scalable systems to support business growth

Balancing Cost and Features

When choosing an ROI tool, weigh the upfront costs against the long-term benefits. Start with the basics and add more features as your business expands. For example, Rundit offers advanced tools at $299/month [2], which can lead to benefits like:

- Better efficiency in daily operations

- Fewer errors from manual data entry

- Higher client satisfaction

- Smarter, data-driven decisions

The right tool should clearly show its value by improving how you work and how you serve clients. Begin with the essentials and ensure the tool can grow with your business, so it remains a good fit as your needs evolve.

Key ROI Metrics Financial Advisors Should Track

Keeping an eye on the right metrics is crucial for assessing ROI tools and making informed business decisions.

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) tells you how much it costs to bring in a new client. For example, if you spend $10,000 on marketing and gain 10 clients, your CAC is $1,000 per client. Knowing this figure helps you allocate budgets effectively, evaluate marketing efforts, and plan for future growth.

Tracking Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) calculates the total revenue a client brings over their entire relationship with your business. For instance, if a client generates $5,000 annually for 10 years and retention costs are $1,000, their CLV is $40,000. Research from FYIsoft highlights that using the right financial reporting tools can increase productivity by up to 50% and cut financial close times by 70% [1].

Monitoring Conversion and Churn Rates

Keep tabs on conversion rates (how many prospects become clients), churn rates (how many clients leave), and engagement levels to gauge the overall health of your practice.

"Data analytics can help advisors retain clients by identifying risks early and implementing targeted strategies."

Popular ROI Reporting Tools for Financial Advisors

These tools are designed to help financial advisors track marketing efforts, analyze performance metrics, and make smarter decisions.

Google Analytics

Google Analytics offers free, in-depth insights into how your website performs. It tracks key metrics like lead form submissions, page views, and even the geographic locations of potential clients.

HubSpot

Starting at $50/month, HubSpot provides tools like lead scoring, email tracking, and client journey mapping. It also includes marketing automation features to help prioritize leads and simplify communication.

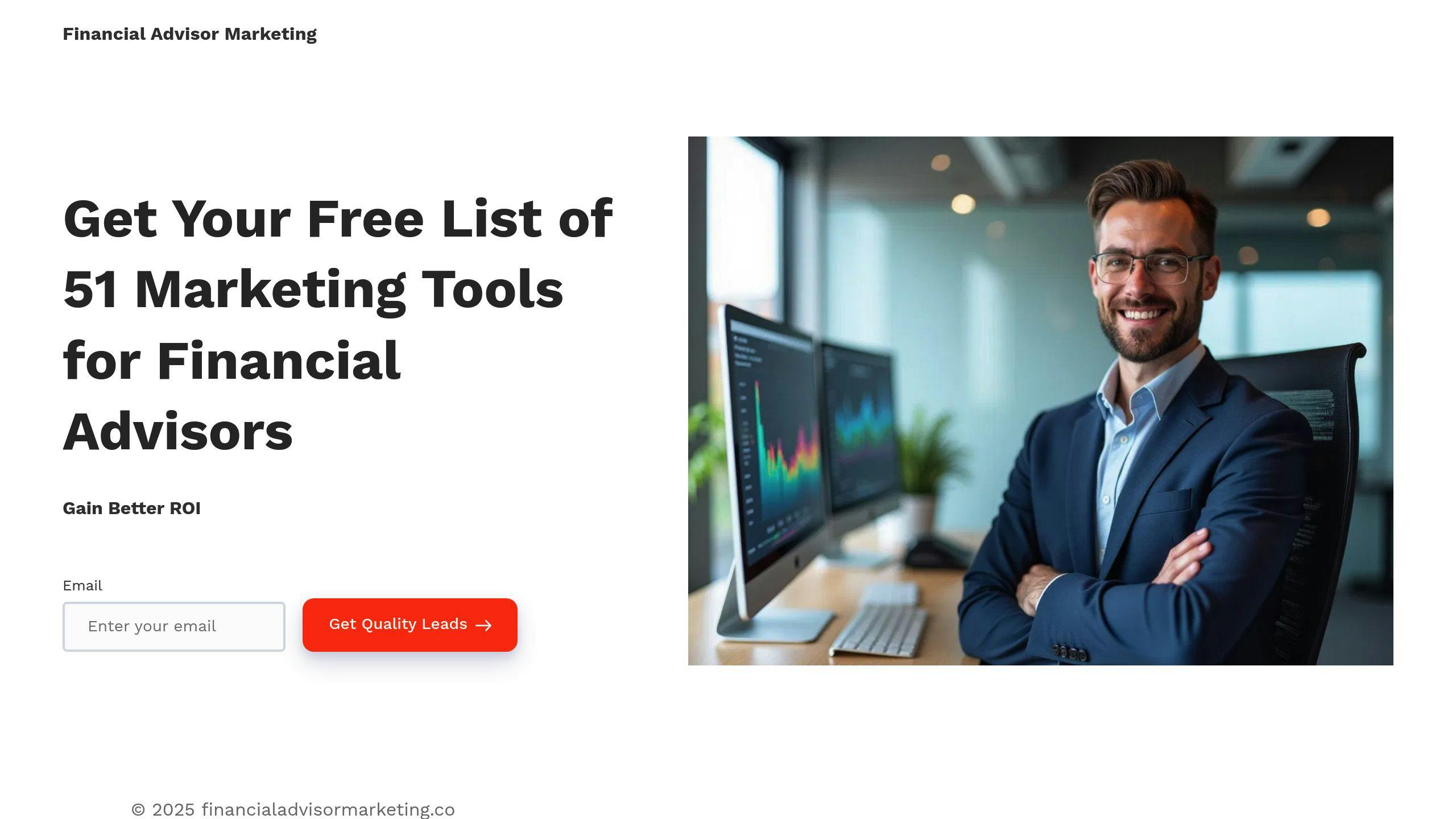

Financial Advisor Marketing

This platform focuses on tracking acquisition costs, evaluating campaign effectiveness, and fine-tuning lead generation efforts. It also provides a curated list of 51 tools tailored specifically for financial advisors.

Mixpanel

Mixpanel, with plans starting at $25/month, specializes in real-time analytics and custom event tracking. It helps measure campaign ROI and offers insights into client behavior, enabling advisors to adjust strategies for better results.

With these options, consider which tool fits your business goals and take the time to assess their features carefully.

sbb-itb-e3190ce

Steps to Select the Right ROI Tool for Your Business

Identify Your Business Goals

Start by pinpointing the metrics that drive your growth, whether it’s lead management, client retention, or something else. Tools should align with these priorities. Metrics like CAC (Customer Acquisition Cost) and CLV (Customer Lifetime Value), mentioned earlier, can help steer your decision-making.

For instance, if improving lead tracking is your main focus, look for tools with strong lead management features and integrations with your CRM. On the other hand, if client engagement is key, choose platforms that offer client portals and customizable reporting. Once you've outlined your goals, you’ll need to evaluate and compare tools to find the right match.

Try and Compare Different Tools

Take advantage of free trials or demos to see how various tools work for your business. Evaluate them based on these essential criteria:

| Evaluation Criteria | What to Look For |

|---|---|

| Integration Capabilities | Seamless compatibility with your CRM and marketing tools |

| Customization Options | Flexibility to create personalized reports and dashboards |

| User Experience | Easy-to-use interface, training materials, and support |

| Price vs. Features | A balance between cost and functionality that fits your budget |

For example, while Google Analytics is excellent for website analytics, a tool like HubSpot might be better if you also need marketing automation and ROI tracking.

Use Trusted Recommendations

Tap into industry resources and peer feedback to validate your choice. Expert-curated lists can help you narrow down tools that work well for businesses like yours.

"Expert insights on integration, customization, and scalability should guide your ROI tool selection process. Consider the opinions of other financial advisors who have practical experience with these tools."

For example, platforms like AdvisorEngine are known for their onboarding support, helping teams quickly get up to speed. The ideal tool isn’t necessarily the one with the longest feature list - it’s the one that aligns best with your goals and how your team works.

Conclusion: Simplify ROI Tracking to Grow Your Practice

Key Takeaways

Tracking ROI effectively is a must for financial advisors looking to improve their performance. The ideal tool should monitor essential metrics like CAC and CLV, work seamlessly with your current systems, and scale with your practice's growth. It should also be easy to use, so your team can gain valuable insights without unnecessary complications.

By focusing on these factors, you’ll be better equipped to evaluate and test tools to find the one that fits your needs.

Choosing the Right ROI Tool

When picking an ROI reporting tool, keep these factors in mind:

| Component | What to Look For |

|---|---|

| Cost Analysis | Account for upfront costs, recurring fees, and training expenses |

| Benefits Assessment | Look at potential efficiency boosts, productivity gains, and overall returns |

| Implementation Timeline | Check how long it takes to set up, train your team, and start seeing results |

Start by exploring platforms that offer free trials to see how they perform in practical settings. Resources like Financial Advisor Marketing’s guide to 51 marketing tools can help narrow down your options, focusing on tools tailored for financial advisors.

Make ROI tracking a regular part of your strategy to stay on top of your practice’s growth. Begin testing tools with free trials and take the first step toward improving your ROI tracking today.

FAQs

What are three components of determining the ROI of software?

To calculate the ROI of software, you need to focus on three main cost areas: setup costs, recurring fees, and maintenance and support. These areas help you create a clear budget and avoid any surprise expenses.

| Cost Component | Description |

|---|---|

| Setup Costs | Initial expenses for implementation and training. |

| Recurring Fees | Ongoing subscription fees (monthly or yearly). |

| Maintenance & Support | Costs for updates, technical support, and system upkeep. |

When evaluating software tools, it's smart to assess costs in all these areas. Asking vendors for a detailed cost breakdown can help you plan better and understand the total cost of ownership.