Financial advisors in 2025 face three big challenges: standing out in a crowded market, attracting high-net-worth clients, and building trust online. The solution? Using digital tools that simplify marketing, ensure compliance, and improve client relationships.

Here’s a quick overview of the top tools covered:

- ActiveCampaign: Email marketing with automation and lead scoring.

- MailerLite: Affordable email marketing for smaller practices.

- Kapitalwise: AI-driven lead generation for high-net-worth clients.

- SmartAsset: Pay-per-lead platform for mass affluent investors.

- Zoe Financial: Matches advisors with ultra-affluent clients.

- Harness Wealth: Combines financial, tax, and legal services to boost visibility.

- Wealthtender: Directory and content-sharing platform for organic growth.

- Google Ads: Paid search campaigns targeting high-intent prospects.

- Meta Ads: Social media advertising on Facebook and Instagram.

- Email Extractor Tool: Simplifies lead generation by collecting verified emails.

Quick Comparison Table

| Tool | Best For | Key Feature | Starting Cost |

|---|---|---|---|

| ActiveCampaign | Email automation | Lead scoring, segmentation | $9/month |

| MailerLite | Budget-friendly email marketing | A/B testing, simple workflows | $0/month |

| Kapitalwise | High-net-worth lead generation | Behavioral analysis | Pay-per-lead |

| SmartAsset | Mass affluent lead generation | Volume-based lead system | Pay-per-lead |

| Zoe Financial | Ultra-affluent client matching | Performance-based pricing | % of AUM |

| Harness Wealth | Advisor visibility | Pre-qualified leads | Custom |

| Wealthtender | Organic growth | Content sharing, free profiles | Free |

| Google Ads | Paid search campaigns | Keyword targeting | Custom |

| Meta Ads | Social media ads | Custom audiences, retargeting | Custom |

| Email Extractor | Lead generation | Email validation | $37.99 |

To succeed in 2025, financial advisors need to combine these tools into a cohesive digital strategy that connects with clients effectively while staying compliant.

Related video from YouTube

1. ActiveCampaign: Email and Automation Made Simple

ActiveCampaign is an email marketing tool designed to simplify outreach and automation for financial advisors. It offers advanced tools for segmenting and targeting, helping advisors create personalized campaigns for high-net-worth clients. For example, if a prospect downloads a financial guide, the platform can automatically send tailored follow-up emails to nurture that lead - all while staying compliant with industry regulations.

"Email marketing is no longer just about sending emails; it's about creating personalized experiences that drive real results." - Jason VandeBoom, Founder of ActiveCampaign

The platform integrates easily with CRM systems and financial tools, giving advisors a complete view of client interactions. This not only improves communication but also cuts down on repetitive tasks.

Pricing Plans

ActiveCampaign offers plans for different needs:

| Plan Level | Monthly Cost | Ideal For |

|---|---|---|

| Lite | $9 | Solo advisors |

| Plus | $49 | Growing practices |

| Professional | $149 | Established firms |

| Enterprise | Custom | Large firms |

Each plan includes core features designed to enhance marketing efforts and deliver measurable outcomes.

Why Financial Advisors Choose ActiveCampaign

- Lead Scoring: Pinpoint high-potential clients with ease.

- Analytics: Gain insights to fine-tune your campaigns.

- Segmentation: Send targeted messages to the right audience.

ActiveCampaign also includes tools to ensure compliance with financial regulations, making it a reliable choice for advisors managing both marketing strategies and regulatory requirements. Its analytics and automation features provide everything needed to optimize campaigns and focus on what matters most - building client relationships.

2. MailerLite: Budget-Friendly Email Marketing for Advisors

MailerLite is a straightforward email marketing tool designed to help financial advisors connect with clients without unnecessary complications or high costs. In a field where personalized communication is key, MailerLite makes it easier to stay in touch with clients while keeping expenses low.

The platform offers plans starting at $0 for up to 1,000 subscribers. Advanced features like A/B testing and priority support are available in higher-tier plans:

| Plan Type | Subscribers | Monthly Cost | Key Features |

|---|---|---|---|

| Free | Up to 1,000 | $0 | Basic templates, email automation |

| Growing Business | Up to 1,000 | $10 | A/B testing, custom domains |

| Advanced | Up to 2,500 | $15 | Priority support, custom HTML |

| Enterprise | Custom | Custom | Dedicated manager, API access |

MailerLite stands out by offering the tools financial advisors need to communicate effectively. Its user-friendly interface simplifies tasks like email creation and CRM integration, ensuring client data stays up-to-date across platforms. Advisors can also monitor performance metrics - such as open rates and engagement - through an intuitive analytics dashboard.

The platform’s segmentation tools allow advisors to send tailored messages to specific client groups, such as near-retirees or high-net-worth individuals. This targeted communication boosts engagement and helps advisors demonstrate their expertise to potential clients.

Key features financial advisors will appreciate include:

- Built-in unsubscribe management

- Double opt-in verification for compliance

- Email scheduling that accounts for time zones

- Automated compliance footers

With a Trustpilot rating of 4.7/5 based on over 2,500 reviews, MailerLite has earned a reputation as a dependable option for financial professionals who want effective email marketing without unnecessary complexity or expense.

For advisors looking for more advanced tools for personalized communication, Kapitalwise offers specialized platforms tailored to their needs.

3. Kapitalwise: Personalized Client Engagement

Kapitalwise is a platform designed to help financial advisors connect with high-net-worth clients in a competitive market. It uses advanced algorithms to analyze client behavior and financial data, making it easier to identify individuals actively seeking advisory services.

Here’s what Kapitalwise brings to the table:

| Feature | Benefit |

|---|---|

| Advanced Matching | Pinpoints high-net-worth prospects with strong intent |

| Automated Nurturing | Simplifies follow-ups, saving valuable time |

| Custom Landing Pages | Boosts lead conversion with tailored messaging |

Kapitalwise integrates seamlessly with tools like financial advisory CRMs, offering a unified view of client engagement. Its automated follow-up system adapts to client actions - like website visits or email interactions - ensuring timely and relevant communication.

The platform specializes in identifying qualified leads based on wealth levels and investment interests. With a pay-per-lead pricing model, advisors can track ROI and adjust marketing efforts to fit their budget and growth plans.

To get the most out of Kapitalwise, advisors should:

- Create tailored landing pages that clearly communicate their value.

- Use automation tools to maintain consistent engagement.

- Leverage CRM integration to keep client data accurate and actionable.

Kapitalwise equips advisors with tools to craft personalized strategies that resonate with potential clients. Its mix of advanced tech and customization options makes it a strong choice for modernizing advisory marketing.

For a broader reach, advisors might also consider tools like SmartAsset, which can complement Kapitalwise with additional lead generation capabilities.

4. SmartAsset: Connecting Advisors with Clients

SmartAsset helps advisors maintain a steady flow of qualified prospects by linking them with mass affluent investors. Using a pay-per-lead model, the platform ensures a consistent pipeline of potential clients.

| Feature | Description |

|---|---|

| Lead Quality Tiers | Organize leads by wealth categories with flexible pricing. |

| Volume-Based System | Deliver a steady stream of mass affluent leads. |

| Lead Management | Manually import and track leads for complete control. |

What makes SmartAsset effective is its straightforward method of connecting advisors to prospects. This hands-on approach is ideal for advisors who prefer direct control over nurturing leads.

Tips for Getting the Most Out of SmartAsset

- Optimize Your Profile: Highlight your expertise, services, and ideal client demographics to attract the right leads.

- Streamline Lead Management: Set up a clear system for tracking and following up with leads.

- Focus on ROI: Keep an eye on conversion rates and prioritize leads that deliver the best return.

SmartAsset offers limited support options and self-service tools, which gives advisors the flexibility to create tailored follow-up and engagement strategies.

For advisors aiming to grow their practice, SmartAsset’s volume-driven model is a practical way to maintain a steady stream of prospects. It performs best when combined with a broader marketing plan that includes personalized outreach and relationship-building efforts.

If you're comparing SmartAsset to other lead generation tools, keep in mind that it specializes in connecting advisors with mass affluent investors. This makes it a strong choice for advisors looking to grow their client base in this segment. On the other hand, Zoe Financial may be a better fit for those targeting high-net-worth clients.

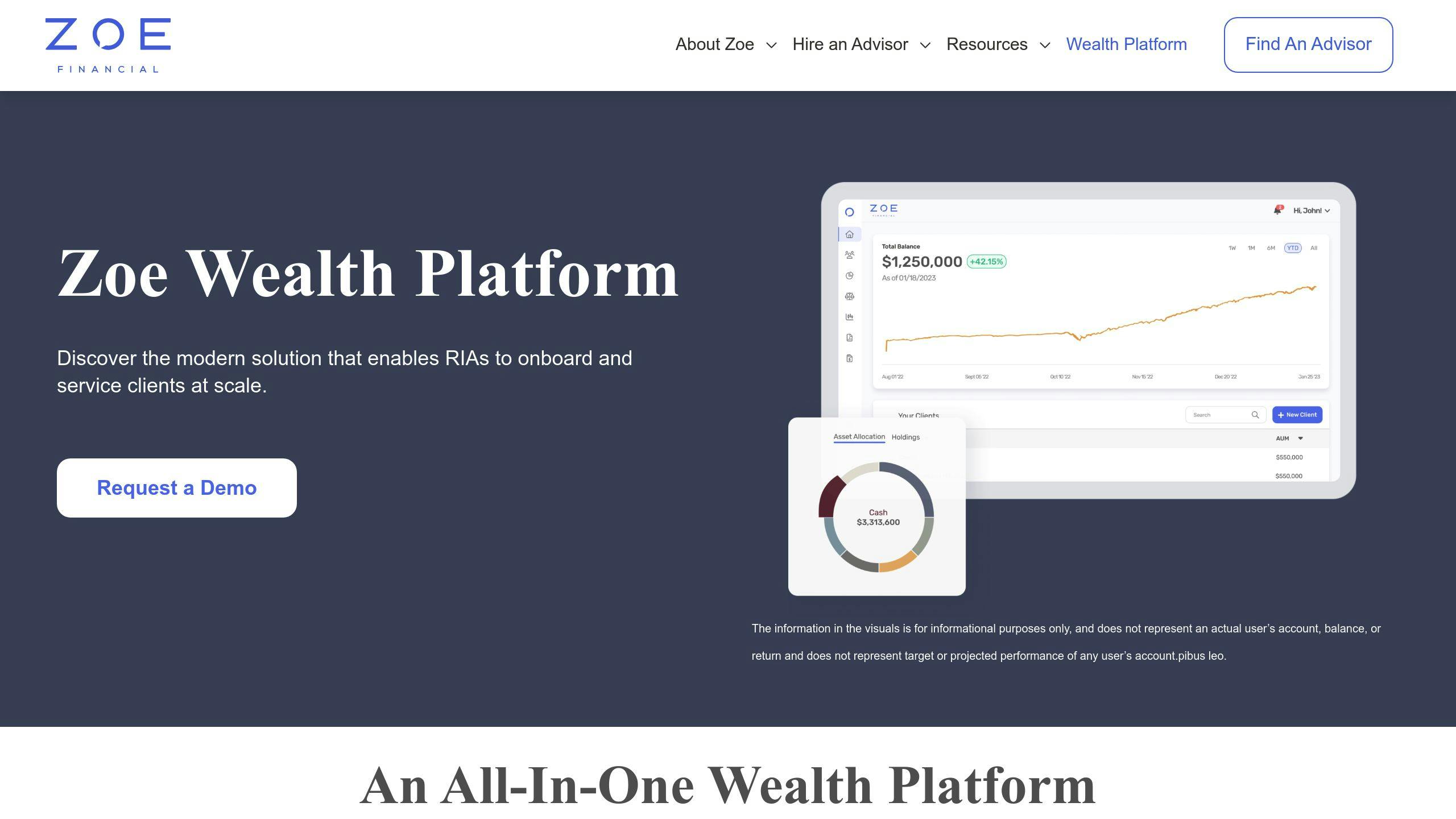

5. Zoe Financial: A Platform for Connecting with High-Net-Worth Clients

Zoe Financial is designed to link financial advisors with affluent clients through a personalized, concierge-style matching system. It focuses on ultra-affluent investors, making it a strong option for advisors aiming to build relationships with high-net-worth individuals.

| Feature | What It Offers |

|---|---|

| Targeted Matching | Pairs advisors with pre-screened, high-intent prospects suited to their expertise |

| Performance-Based Pricing | Advisors pay only after successfully acquiring clients |

| Ongoing Support | Provides coaching and client service assistance for advisors |

Zoe Financial uses advanced algorithms and a pre-qualification system to match advisors with the right prospects. Instead of paying for leads upfront, advisors pay a percentage of assets under management, directly tying costs to results.

Tips for Making the Most of Zoe Financial

Advisors can get the best results by creating detailed profiles, tailoring their services to affluent clients, and crafting personalized engagement strategies. Zoe Financial also offers extensive support, so advisors can concentrate on delivering financial advice while the platform manages lead matching and client engagement.

In a competitive market, Zoe Financial's quality-driven approach helps advisors connect with ultra-affluent clients. Its focus on aligning client needs with advisor expertise makes it a useful tool for growing a high-net-worth client base.

For those looking to expand their reach even further, Harness Wealth is another platform worth exploring.

sbb-itb-e3190ce

6. Harness Wealth: Building Advisor Visibility

Harness Wealth connects financial advisors with affluent clients by combining financial, tax, and legal services on one platform. It helps advisors stand out in a competitive market by showcasing their expertise and ensuring they reach the right audience.

| Feature | What It Offers |

|---|---|

| Integrated Services | Brings together financial planning, tax, and legal experts for seamless collaboration. |

| Profile Optimization | Tailored support to help advisors enhance their visibility. |

| Pre-qualified Leads | Matches advisors with clients based on specific skills and client needs. |

| Account Support | Provides dedicated help with engagement strategies. |

The platform ensures meaningful connections by matching advisors with clients based on their expertise. This approach allows advisors to demonstrate their skills to clients who need comprehensive financial solutions.

Advisors can achieve the best results by fine-tuning their profiles, using the platform’s matching tools, and taking advantage of account support. This focus on specialized expertise helps advisors maintain high standards while earning the trust of clients seeking well-rounded financial guidance.

Though Harness Wealth emphasizes visibility through targeted matching, Wealthtender takes a broader route, helping advisors connect with clients across multiple channels.

7. Wealthtender: A Hub for Financial Advisors

Wealthtender provides financial advisors with a platform to stand out in a competitive online space. By combining directory listings with opportunities to share expertise, it helps advisors boost their visibility and build trust. Features like free profiles, content sharing, and CRM tools make it easier for advisors to connect with potential clients looking for financial guidance.

| Feature | What It Offers |

|---|---|

| Freemium Profile | Start with a free listing, with options to upgrade for better visibility |

| Content Showcase | Publish articles to demonstrate expertise and earn trust |

| Lead Generation | Connect with investors actively seeking financial advice |

| CRM Integration | Simplify profile updates and track potential leads effectively |

Wealthtender allows advisors to highlight their specialties, whether it’s retirement planning or wealth management. By sharing articles and insights directly on the platform, advisors can position themselves as trusted experts and stand apart from competitors.

Starting is simple: advisors can create a free profile and later upgrade for more exposure. Wealthtender also provides coaching and resources to help advisors refine their profiles and attract the right clients.

"Wealthtender helps advisors attract high-quality leads by showcasing expertise and building trust."

This platform’s focus on content helps advisors demonstrate their skills while forming genuine connections with potential clients. While Wealthtender emphasizes organic growth and engagement through content, tools like Google Ads offer a paid route to target clients searching for financial guidance.

8. Google Ads: Reaching Clients Through Search

Google Ads offers a paid approach to connect directly with clients actively searching for financial services. Unlike platforms like Wealthtender, which focus on organic visibility, Google Ads allows financial advisors to stand out in a competitive market. For every $1 spent, advertisers typically see a $2 return, making it a reliable option for targeting high-intent prospects.

One of the platform's strengths is its ability to target with precision. Advisors can focus on specific keywords, demographics, and locations to ensure their ads are seen by the right audience. Tools such as Keyword Planner and ad extensions can further improve the effectiveness of campaigns.

| Campaign Element | Best Practice |

|---|---|

| Targeting Strategy | Use financial keywords and focus on relevant geographic areas |

| Ad Extensions | Add phone numbers, location details, and links to services |

| Landing Pages | Build dedicated pages tailored to specific services for better results |

To get the most out of Google Ads, advisors should track lead-generating actions like:

- Form submissions for consultations

- Phone inquiries

- Newsletter signups

- Downloads of financial resources

Google Ads’ built-in analytics tools allow advisors to monitor performance and adjust campaigns as needed. Features like ad extensions can increase click-through rates without extra cost, while the Keyword Planner helps identify effective search terms and steer clear of overly competitive ones.

When paired with optimized landing pages, Google Ads becomes a dependable channel for generating leads. For those looking to broaden their reach, Meta Ads can serve as a great complement with its own advanced targeting options.

9. Meta Ads: Social Media Advertising for Advisors

Meta Ads helps financial advisors connect with potential clients through personalized campaigns on Facebook and Instagram. With 70% of adults aged 30-49 using these platforms [1], it’s a powerful way to stand out in the crowded digital landscape.

The platform’s targeting tools make it easy to reach people who are actively interested in financial services like retirement planning or investment strategies. This ensures your ad spend goes toward connecting with the right audience.

| Ad Format | Best Use Case | Key Benefit |

|---|---|---|

| Image Ads | Brand awareness | Eye-catching visuals with clear messaging |

| Video Ads | Educational content | Boosts engagement and builds trust |

| Lead Ads | Direct lead generation | Easy one-click form submissions |

| Carousel Ads | Service showcase | Highlights multiple offerings in one ad |

Using features like Custom Audiences, advisors can retarget website visitors or upload client lists for tailored campaigns. Lookalike audiences also allow you to reach people similar to your top clients, making your efforts even more effective.

To get the most out of Meta Ads, focus on:

- Clear value propositions that emphasize the benefits of your services

- Professional visuals that establish trust and credibility

- Strong calls-to-action guiding users to resources or next steps

- Compliance with financial regulations to maintain credibility

Meta Ads offers flexible pricing models like CPC or CPM, making it easier to scale campaigns based on your budget. Pairing Meta Ads with email marketing or lead magnets can build a seamless marketing funnel that nurtures prospects effectively.

For an added boost, tools like Email Extractor can help you gather new leads to fuel your Meta Ads campaigns.

10. Email Extractor Tool: Simplifying Lead Generation

The Email Extractor Tool is designed to help financial advisors find and connect with potential clients more efficiently. At $37.99, it offers an affordable solution compared to pricey lead generation services, making it easier to target the right prospects in a competitive landscape.

| Feature | What It Does |

|---|---|

| Targeted Prospecting | Extracts and filters emails from relevant sources to focus on high-value leads |

| Data Management | Organizes contact information for easy integration into your workflow |

| Quality Assurance | Validates emails and ensures compliance with GDPR/CCPA regulations |

With this tool, advisors can:

- Collect leads from industry events or professional networks

- Find potential partners in the financial sector

- Reach niche markets to expand their client base

- Build focused email lists while staying compliant with regulations

For best results, consider these strategies:

- Use verified email lists to create custom audiences for ad platforms like Meta Ads.

- Craft tailored email sequences using your marketing automation tools.

- Research overlooked niches or underserved demographics to refine your outreach.

Always ensure compliance with email marketing laws when using this tool. Validate all emails and secure proper opt-ins before reaching out to prospects. This keeps your campaigns effective and within legal boundaries.

Conclusion

Digital marketing tools have become essential for financial advisors aiming to thrive in 2025. These tools address the key challenges of navigating a digital-first environment, such as standing out in a competitive market, attracting the right clients, and building trust online.

Platforms like ActiveCampaign and MailerLite, when paired with financial advisor-specific tools such as Kapitalwise and SmartAsset, create a streamlined process - from generating leads to converting them into clients. This integration boosts efficiency and delivers measurable results.

A well-rounded strategy combining email marketing, lead generation, and digital advertising is crucial for connecting with and converting high-value clients. The key is to use these tools as part of an integrated approach rather than in isolation. Advisors who embrace these tools, produce meaningful content, and enhance their personal brand are setting themselves up for growth in 2025 [1][3].

Tracking critical metrics, such as email open rates, lead conversion rates, and ROI, can help ensure your strategy remains effective and flexible [2]. Monitoring these numbers keeps your efforts focused and results-driven.

FAQs

Do Google Ads work for financial advisors?

Yes, Google Ads can be an effective tool for financial advisors when used thoughtfully. It offers several advantages for connecting with potential clients.

Reaching the Right Audience: Google Ads helps financial advisors connect with individuals actively searching for financial services, making it easier to attract high-net-worth prospects [2].

Tracking Performance: The platform provides detailed analytics, so you can monitor metrics like click-through rates (CTR), conversion rates, and costs per conversion to evaluate how well your campaigns are working [3].

Tips for Better Results:

- Write ad copy that speaks to specific financial concerns, such as retirement planning.

- Make sure your landing pages match the message of your ads to create a smooth experience for users.

- Use tools like conversion tracking and analytics to fine-tune your campaigns [2].

When combined with platforms like Meta Ads, Google Ads can be part of a broader digital marketing plan to attract and convert high-value clients in 2025 [1][2].