Securing CMS plugins is critical for financial advisors to protect sensitive client data and maintain regulatory compliance. WordPress, which powers 62.8% of websites, accounts for 95.5% of CMS-related security issues. Common risks include outdated plugins, SQL injection, XSS attacks, and RCE vulnerabilities. A single breach can lead to data exposure, compliance violations, reputational damage, and financial loss.

Key Steps to Protect Plugins:

- Regular Updates: Install security patches immediately and update plugins monthly.

- Evaluate Plugins: Choose plugins with active support, frequent updates, and strong user ratings.

- Limit Plugins: Use only necessary plugins to reduce vulnerabilities.

- Security Tools: Use scanners like Sucuri, WPScan, and Wordfence to monitor threats.

- Staff Training: Educate your team on plugin risks and enforce strict access controls.

Quick Plugin Security Checklist:

| Step | Frequency | Tools/Actions |

|---|---|---|

| Update Plugins | Weekly/Monthly | Prioritize security patches |

| Scan for Vulnerabilities | Weekly/Daily | Use Sucuri, WPScan, or Wordfence |

| Review Permissions | Quarterly | Implement role-based access |

| Conduct Security Audits | Bi-annual | Review and document configurations |

By actively managing and monitoring plugins, financial advisors can mitigate risks, protect client trust, and ensure compliance.

Understanding Risks of CMS Plugin Security

Common CMS Plugin Vulnerabilities

CMS plugins can pose serious security risks for financial advisory websites. The main issues arise from outdated code, poorly designed plugins, and vulnerabilities to malware attacks.

Here are some common attack methods targeting CMS plugins:

| Attack Type | Description | Potential Impact |

|---|---|---|

| SQL Injection | Malicious code is injected into databases, allowing attackers to access sensitive information | Theft of client financial data |

| Cross-Site Scripting (XSS) | Scripts are injected to hijack user sessions or redirect users | User session compromise |

| Remote Code Execution (RCE) | Unauthorized code is executed to gain control of the system | Full system takeover |

Specific Risks for Financial Advisors

Financial advisors face unique risks when it comes to CMS plugin security. Handling sensitive client financial data and adhering to strict regulations makes the stakes much higher. Many third-party plugins lack consistent security measures, leaving financial advisors vulnerable to potential breaches.

A compromised plugin could expose sensitive client information, such as portfolios or financial plans. The fallout from such an event goes beyond technical disruptions and can have long-term consequences. Key risks include:

| Risk Category | Impact on Financial Advisory Practices |

|---|---|

| Data Breaches | Client financial information is exposed to unauthorized parties |

| Compliance Violations | Non-compliance with GDPR or PCI DSS can result in penalties |

| Service Disruption | Clients may lose access to their accounts or important services |

| Reputational Damage | Loss of client trust and credibility |

For financial advisors, plugin security isn't just a technical concern - it’s directly tied to client trust, regulatory compliance, and the overall integrity of their services. A single breach can lead to unauthorized access, altered financial data, and significant disruptions to operations [1].

Recognizing these risks is crucial. Up next, we'll focus on how to thoroughly assess plugin security to protect your business and clients.

How to Check Plugin Security

According to WPScan, 94% of WordPress security issues are linked to plugin vulnerabilities. This makes it critical for financial advisors to evaluate plugin security to protect client data and stay compliant with regulations.

Key Factors for Evaluating Plugin Security

When choosing CMS plugins, keep these factors in mind:

| Factor | What to Look For |

|---|---|

| Developer Reputation | Developers with active support and quick fixes versus those with poor support records. |

| Update Frequency | Plugins updated within the last 6 months versus those untouched for over a year. |

| Installation Base | A strong user base (1,000+ installations) and plenty of feedback. |

| Compatibility | Verified compatibility with your CMS’s latest version. |

| User Rating | 4+ stars and a significant number of reviews. |

"Before you install any plugin or theme on your website, it's important to ensure that it comes from reputable developers and that it has a good track record."

- Jen Swisher, Customer Experience Specialist for Jetpack

Tools for Assessing Plugin Security

Several tools can help you evaluate plugin security, both before and after installation:

| Tool | Primary Use |

|---|---|

| Sucuri SiteCheck | Scans for malware and blacklist issues. |

| WPScan | Identifies vulnerabilities and provides access to a vulnerability database. |

| Patchstack | Offers real-time security monitoring. |

| Detectify | Automates vulnerability assessments. |

When using these tools, focus on these areas:

- Security Ratings: Overall safety scores for plugins.

- Vulnerability Reports: Lists of known issues.

- Code Quality: Whether the plugin follows coding standards.

- Update History: How often security patches are released.

For financial advisors, regularly using these tools is essential to safeguarding sensitive client information and meeting compliance standards. By identifying risks early, you can reduce the chance of exploitation.

After evaluating plugin security, the next step is to implement strategies to keep them secure over time.

Steps to Secure CMS Plugins

Once you've assessed the security of your plugins, it's time to take action to keep your website safe. For financial advisors, ensuring plugin security is critical to protecting both their practice and their clients from potential risks.

Update Plugins Regularly

Keeping plugins up to date is one of the simplest yet most effective ways to secure your website. Here's how to prioritize updates:

| Update Type | Timing | What to Do |

|---|---|---|

| Security Patches | Immediately | Install within 24 hours |

| Routine Updates | Weekly or Monthly | Schedule during low-traffic times |

Limit and Remove Unnecessary Plugins

The fewer plugins you use, the fewer opportunities there are for security issues. Stick to plugins that are absolutely necessary for your business operations. By reducing the number of plugins, you lower your risk and make your site easier to manage.

After cutting down on plugins, take the time to fine-tune the security settings of the ones you keep.

Configure Plugin Settings for Stronger Security

Properly setting up your plugins is essential for keeping your site secure. Pay attention to these key areas:

| Setting | How to Apply | Why It Matters |

|---|---|---|

| Authentication & Encryption | Enable two-factor authentication (2FA) and encrypt data | Protect against unauthorized access and secure data transfers |

| User Permissions | Use role-based access controls | Restrict access to sensitive areas |

Regularly review and adjust these settings to stay ahead of potential threats. Document all security configurations and review them every quarter to ensure they meet current security standards and regulatory guidelines. Use automated tools to scan for vulnerabilities and address any issues promptly.

sbb-itb-e3190ce

Monitoring and Maintaining Plugin Security

Once your CMS plugins are secure, keeping an eye on them and maintaining them regularly is key to avoiding new vulnerabilities. Financial advisors should have reliable monitoring systems in place to guard against ever-changing security risks.

Use Tools to Scan for Security Issues

Security scanning tools can simplify the task of protecting CMS plugins by automating the process. Below are some tools and how often you should run them:

| Tool Name | Recommended Scan Frequency |

|---|---|

| Wordfence | Daily scans |

| Sucuri | Weekly scans |

| MalCare | Bi-weekly scans |

Set these tools to send alerts for any unusual activity. This way, you can address potential breaches before they become serious problems. Once you've set up these tools, the next step is creating a solid maintenance routine to keep your site secure over time.

Set Up a Plugin Maintenance Schedule

A regular maintenance schedule helps keep your site protected. Here's a breakdown of tasks and how often to perform them:

| Maintenance Task | Frequency |

|---|---|

| Security Scans | Weekly |

| Plugin Updates Review | Monthly |

| Access Control Audit | Quarterly |

| Complete Security Audit | Bi-annual |

In environments with multiple users, limit plugin installation rights to specific, trusted individuals. Regular security audits also ensure everyone follows the rules and helps maintain the safety and reliability of your financial advisory website.

Training Staff on Plugin Security

Training your team about CMS plugin risks is crucial for financial advisors to safeguard client data and keep websites secure.

"Most hacks occur because users fail to update plugins or use abandoned ones." - Joel Olawanle, Technical Editor at Kinsta

Training and Policies for Plugin Security

Staff training should emphasize addressing vulnerabilities such as SQL Injections, XSS, and RCE. Establish clear policies to guide plugin management, including:

| Policy Area | Key Requirements |

|---|---|

| Plugin Selection | Choose plugins from reputable sources with 50,000+ active installations |

| Installation Process | Limit installations to authorized IT personnel |

| Update Schedule | Schedule weekly security updates |

| Access Control | Use role-based permissions to manage access |

Hold monthly sessions to review security updates and discuss any incidents. Require staff to document and explain plugin installation requests to maintain strict oversight of your website's security.

A knowledgeable team is essential for maintaining secure plugin practices, but consistent effort and monitoring are key to upholding these standards.

Additional Resources for Financial Advisors

Financial advisors looking to improve CMS plugin security while maintaining strong marketing efforts can benefit from a range of specialized tools and platforms designed to protect digital assets.

Tools to Boost Security and Marketing

| Resource Type | Key Features | Security Benefits |

|---|---|---|

| Security Scanners | Detect vulnerabilities, monitor in real-time | Identifies threats early |

| Marketing Platforms | Lead generation, campaign management | Ensures secure data handling |

| CMS Solutions | Built-in security features, regular updates | Strengthens overall protection |

These tools are designed to work seamlessly with CMS plugins, improving website security without compromising marketing efficiency.

Financial Advisor Marketing

This platform features 51 pre-vetted marketing tools tailored specifically for financial advisors. Each tool is compliant with security standards, ensuring safe implementation. The focus on secure lead generation helps advisors avoid risks commonly associated with third-party tools.

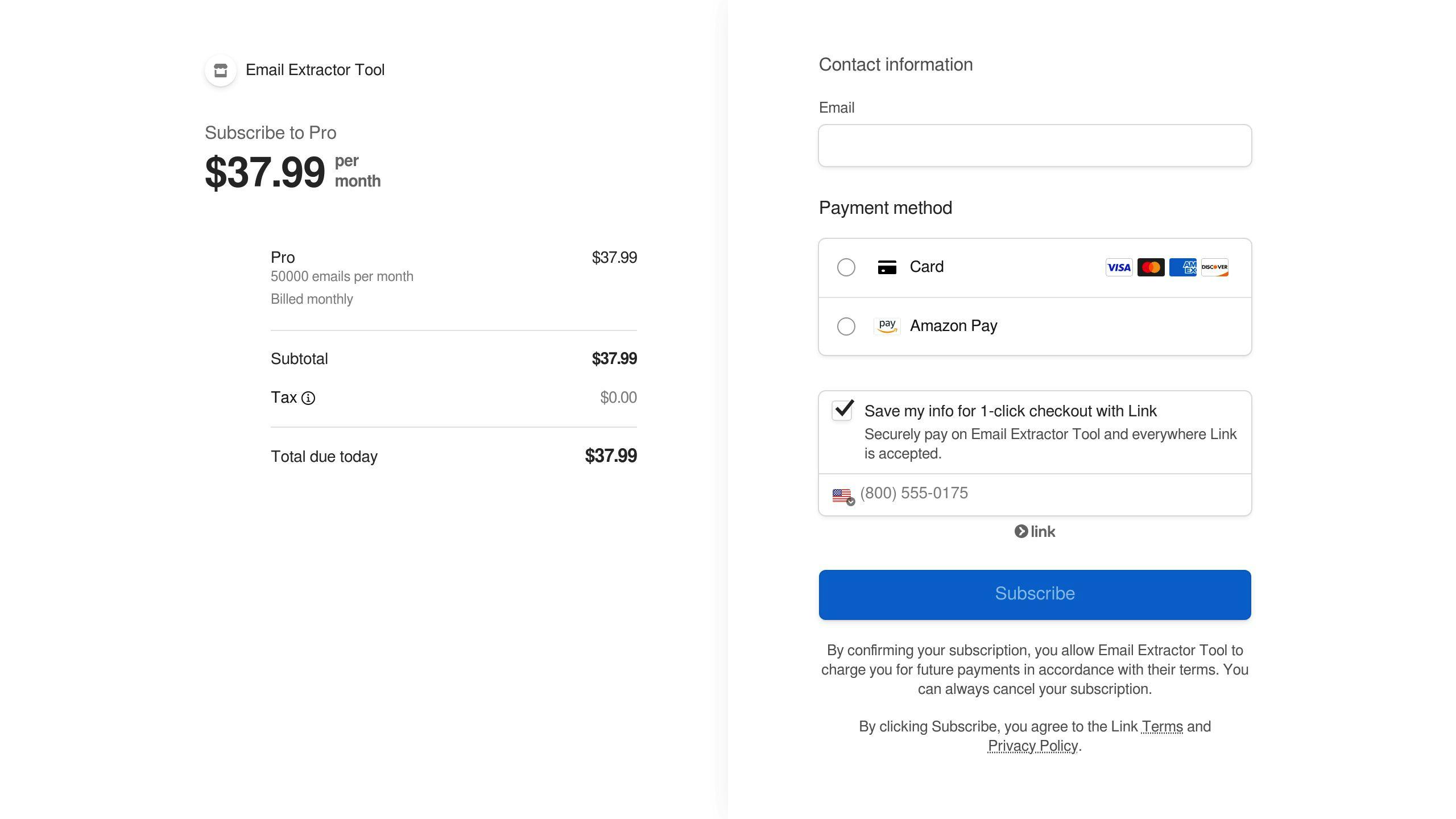

Email Extractor Tool

A tool designed for secure lead generation, offering encryption, compliance features, and CMS integration.

To make the most of these resources, confirm compatibility with your existing security protocols, use role-based access controls to manage permissions, and schedule regular security scans post-integration. These steps can help financial advisors improve website security while running effective marketing campaigns.

Conclusion: Protecting Your Practice with Secure Plugins

Keeping CMS plugins secure is essential for financial advisors. It helps protect sensitive client information, ensures compliance, and shields your reputation from growing cybersecurity risks. Staying ahead of potential threats requires ongoing attention and action.

By actively managing plugins and staying vigilant, financial advisors can build a solid digital foundation. This isn't a one-and-done task - it demands consistent monitoring and updates to keep up with new challenges.

Success in plugin security comes from taking the initiative. Setting clear security guidelines and conducting regular audits can significantly reduce the risk of breaches. These steps form a strong, adaptable defense against cyber threats.

As technology changes, staying on top of updates and addressing new risks will help secure your practice and safeguard your clients' data over the long term.