Drip campaigns are automated email sequences designed to build trust, nurture leads, and keep financial advisors top of mind with clients. They’re easy to set up using CRM tools and offer benefits like consistent communication, personalized content, and measurable results. Here’s what you’ll learn:

- Why Drip Campaigns Matter: Build trust, nurture leads, and achieve a high ROI with minimal effort.

- Key Elements: Segment your audience, create engaging content, and design mobile-friendly emails.

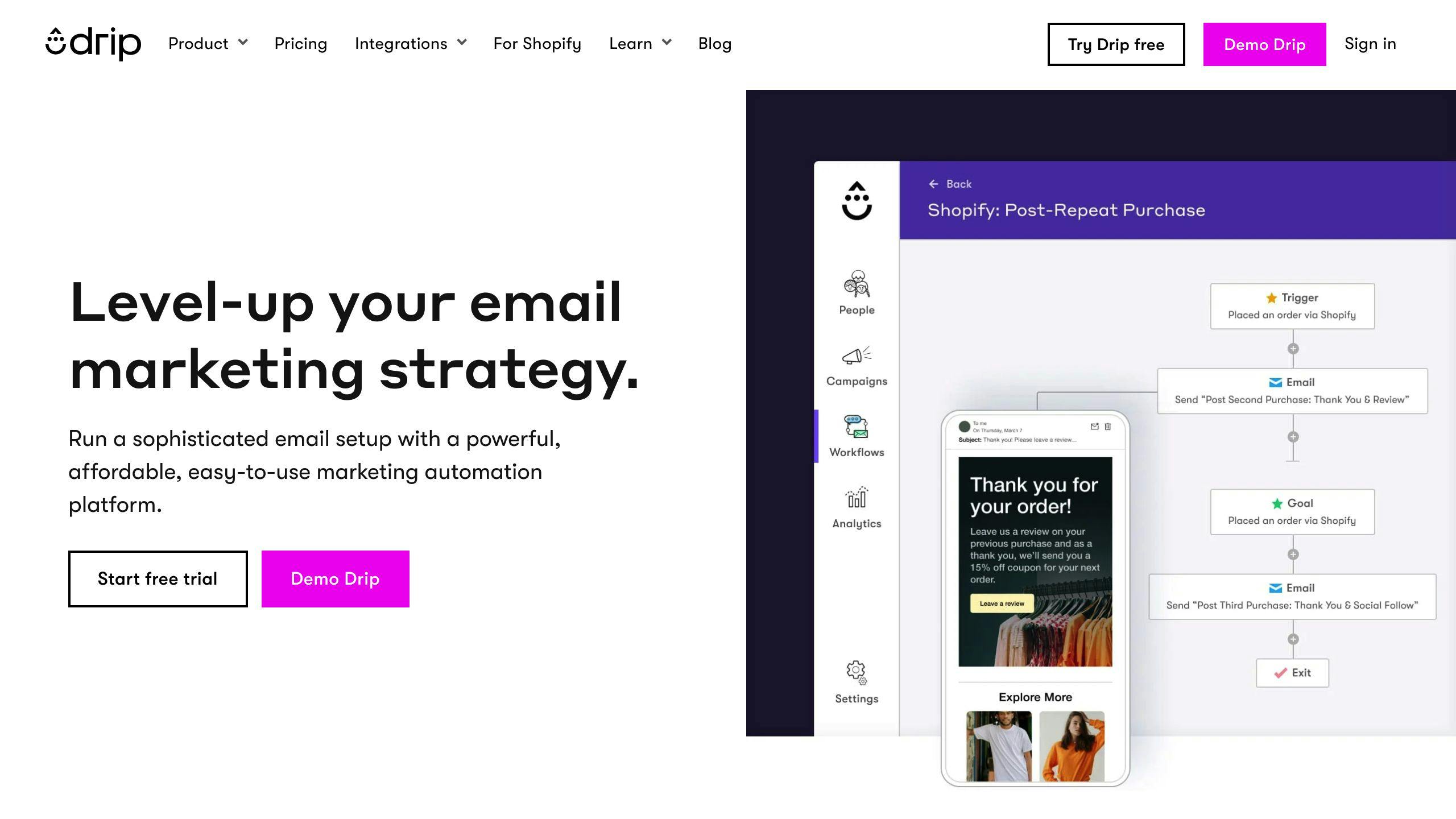

- Using CRM Tools: Automate tasks, track performance, and ensure compliance with tools like Drip or OutboundEngine.

- Success Tips: Personalize emails, monitor metrics (open rates, click-throughs), and refine strategies based on data.

Quick takeaway: Drip campaigns save time, improve client relationships, and help financial advisors grow their practice efficiently.

Elements of an Effective Drip Campaign

Understanding Your Audience

To make your drip campaigns more impactful, start by getting to know your audience and their specific needs. Segment your clients based on their financial goals and communication preferences. This way, you can send them personalized content that speaks directly to their priorities.

Here’s a quick guide to segmenting clients as a financial advisor:

| Client Type | Financial Goals | Preferred Updates |

|---|---|---|

| Retirees | Wealth preservation, income planning | Portfolio updates, market insights |

| New Parents | Education funding, life insurance | Family financial tips, college savings advice |

| Business Owners | Succession planning, tax strategies | Business valuations, tax law updates |

| Pre-retirees | Retirement planning, asset allocation | Investment strategies, retirement readiness |

By tailoring your emails to align with each group’s goals, you can build stronger engagement and trust with your audience.

Creating Engaging Content

Your content should provide clear value while staying compliant with financial regulations. Focus on educational materials that address your clients’ challenges and frequently asked questions.

Types of Content That Work Well:

- Market updates and actionable financial planning tips

- Timely information on tax laws and retirement milestones

- Case studies that highlight successful financial strategies

Designing Effective Campaigns

Your emails need to look great and function well on all devices. Use professional, mobile-friendly templates that are easy to read and reflect your brand.

Key Design Tips:

- Use clean, simple layouts with plenty of white space

- Write clear subject lines that highlight useful content

- Stick to consistent branding, including colors and logos

- Place calls-to-action (CTAs) strategically to guide recipients

Good design not only makes your emails easier to read but also motivates clients to take action. Combine this with CRM tools to fine-tune your campaigns and improve your results [1][4].

Using CRM Tools to Automate Drip Campaigns

After designing a strong drip campaign, pairing it with a CRM tool can take your efforts to the next level by automating tasks and offering detailed insights.

Benefits of Integrating a CRM

CRMs simplify campaign management while helping you stay compliant. They also monitor client interactions and provide valuable data about engagement trends.

| Benefit | What It Does | Why It Matters |

|---|---|---|

| Automation | Schedules emails and centralizes communication | Cuts manual tasks by 70-80% |

| Compliance Support | Keeps records for regulatory purposes | Ensures rules are followed |

| Analytics | Tracks how clients engage with campaigns | Helps refine strategies using data |

CRM Tools Ideal for Financial Advisors

Tools like Drip, OutboundEngine, and UGRU are well-suited for financial advisors, offering features that cater to their specific needs. These include:

- Automated campaign workflows

- Easy-to-manage contact databases

- Detailed engagement and performance reports

- Integration with email and other platforms

Free Marketing Tools from Financial Advisor Marketing

Boost the effectiveness of your drip campaigns by exploring free resources from Financial Advisor Marketing. These tools focus on improving campaign creation, lead generation, and practice growth. When deciding which tools to use, look for features like:

- Advanced segmentation options

- Customizable automation workflows

- Built-in compliance tracking

- Compatibility with current systems

- Detailed analytics and reporting

Combining a reliable CRM with specialized marketing tools gives you a strong framework for running successful drip campaigns while staying compliant and measuring results effectively [1][4].

sbb-itb-e3190ce

Tips for Successful Drip Campaigns

Segmentation and Personalization

Group your clients based on factors like retirement status, career stage, or business ownership to provide content that resonates with their specific needs. For instance, retirees might appreciate advice on estate planning, while younger professionals may be more interested in strategies for building wealth.

Take your segmentation further by tailoring follow-ups to client actions. For example, if someone downloads a retirement guide, send them additional resources on topics like Social Security or healthcare planning to keep the conversation relevant.

Using a reliable CRM can make this process easier by automating data collection and helping you organize and act on client information effectively.

Tracking and Improving Campaign Performance

After segmenting and personalizing your campaigns, it's time to measure how well they're working. Keep an eye on these key metrics:

- Open Rates: Identify which subject lines grab attention and lead to higher engagement.

- Click-Through Rates: See which calls-to-action prompt the most clicks.

- Conversion Tracking: Use your CRM to monitor which emails lead to new clients.

To get the best results from your campaigns:

- Test different sending times to match your audience's habits.

- Keep emails short and focused on a single message or action.

- Experiment with subject lines, formats, and calls-to-action to find what works best.

Always ensure your tracking methods comply with regulatory standards, especially in areas like data protection and privacy. Analytics tools can help you spot trends in engagement, allowing you to fine-tune your timing and content while staying within professional guidelines [3][1][2].

Conclusion and Next Steps

Key Takeaways

Drip campaigns, when integrated with CRM tools, allow financial advisors to automate tailored communication, strengthen client relationships, and save time. By segmenting audiences and monitoring campaign performance, advisors can provide timely updates on market trends, retirement planning, and other financial topics that align with client objectives - all while maintaining compliance [1].

Now, let’s look at how to put your drip campaign into action.

Action Plan

-

Lay the Groundwork

- Select a CRM tool that offers automation, compliance tracking, and analytics.

- Check out Financial Advisor Marketing's curated list of 51 tools to help you find the right fit.

- Define key client segments based on factors like life stage, investment goals, and service tiers.

-

Plan Your Campaign

- Develop content tailored to the needs of each client segment.

- Set up automated workflows to ensure consistent message delivery.

- Incorporate compliance checks throughout the campaign process.

- Launch and Fine-Tune